MyEni Login

The price was reasonable and appropriate to the characteristics of OPL 245, the terms of the contract, and the development recorded on the oil and gas market over time. IT IS A FALSE CLAIM to state that the cost was inflated.

The truth

The final price paid by Eni to acquire the exploration rights for the block was fair and reasonable in the light of a number of factors:

- The characteristics of OPL 245

- The terms of the contract

- The development of the Nigerian and international oil market over previous years

Source: OpenEconomics

A fair financial offer

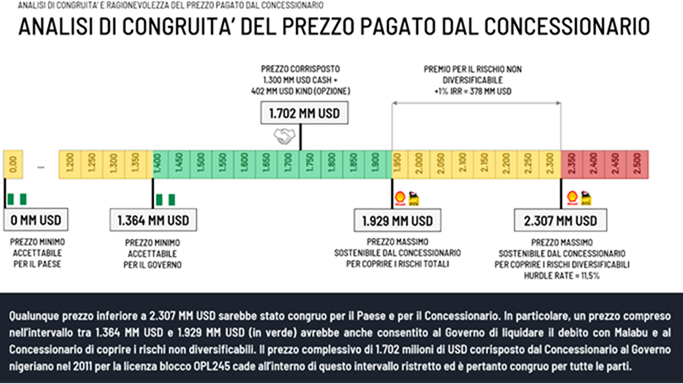

The section of OpenEconomics’ analysis dedicated to the assessment of the price paid by Eni concludes that the financial offer was fair considering the value of Block 245 and the investment required before development could begin. The final amount paid by Eni to the Federal Government of Nigeria (FGN), calculated upon the outcome of a detailed appraisal of geological, technical, and financial considerations, also took into account the development of the Nigerian and international oil and gas market over the years.

Moreover, the transaction price of $1.09 billion, net of the signature bonus, equals the assessment of OPL 245 made by IHS for Shell in its 2009 arbitration against the FGN, when the British/Dutch company had no interest whatsoever in underestimating the asset to which it was laying claim.

More specifically, according to OpenEconomics, with the investment’s internal rate of return (IRR) at 11.5 per cent, the value of the agreement lies between the minimum amount acceptable to the FGN ($1.241 billion) and the maximum amount payable by the license holder ($2.307 billion), thus just below the median value. With an IRR of 12.5 per cent, the value is somewhere between the aforementioned minimum and a maximum of $1.929 billion, well above the median value.

OpenEconomics – “OPL 245 block. Assessment of the price paid”

Read the rest of the facts about Block 245

OPL 245 delivers great benefits to the Nigerian population

Eni made the payment directly to the government

Eni was unaware of how Malabu used the funds

Emeka Obi did not act on behalf of Eni

Eni’s senior management received no bribes

Eni complied with the audit procedures

On the same topic

Eni.com is a digitally designed platform that offers an immediate overview of Eni's activities. It addresses everyone, recounting in a transparent and accessible way the values, commitment and perspectives of a global technology company for the energy transition.

Discover our mission