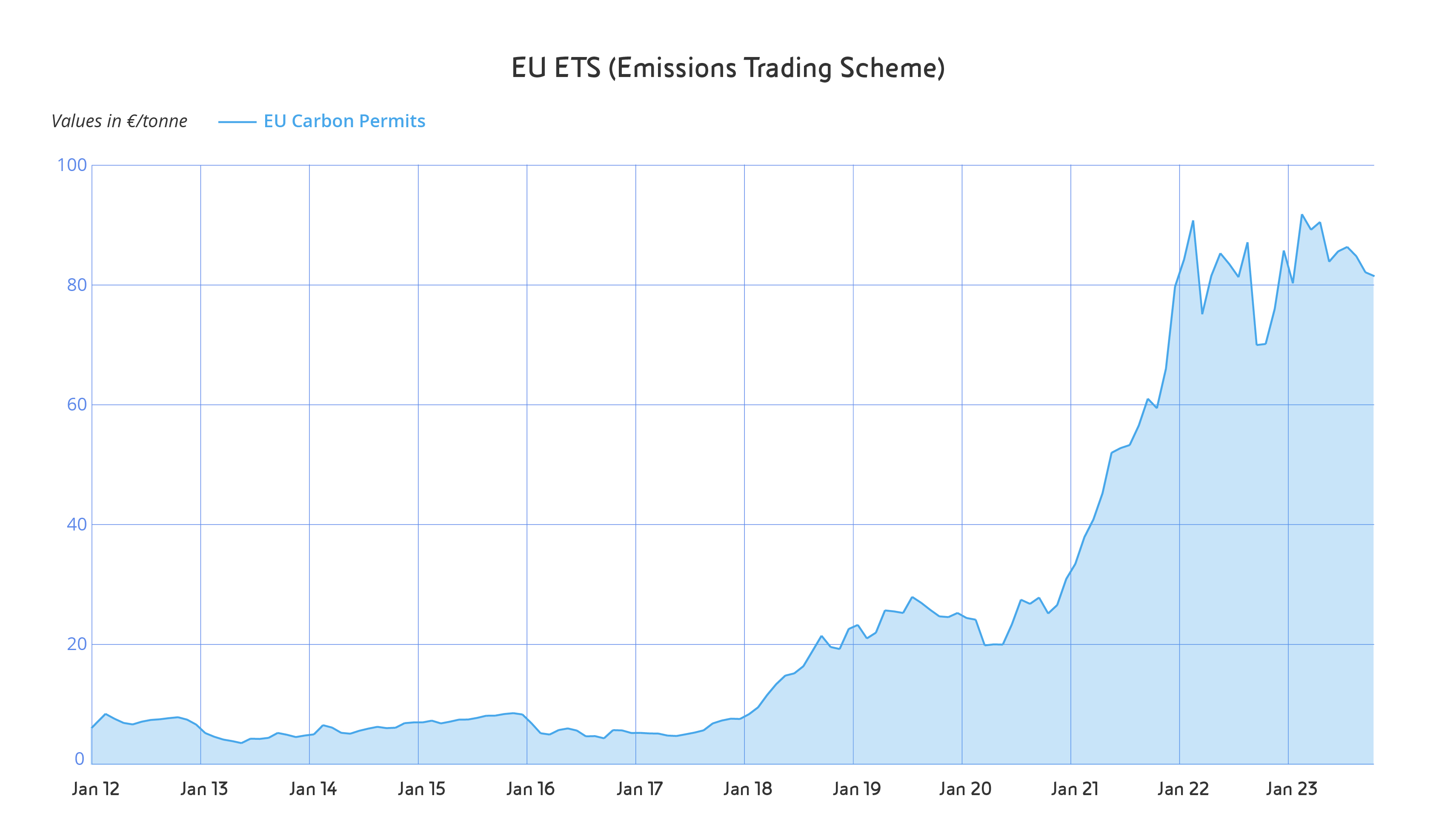

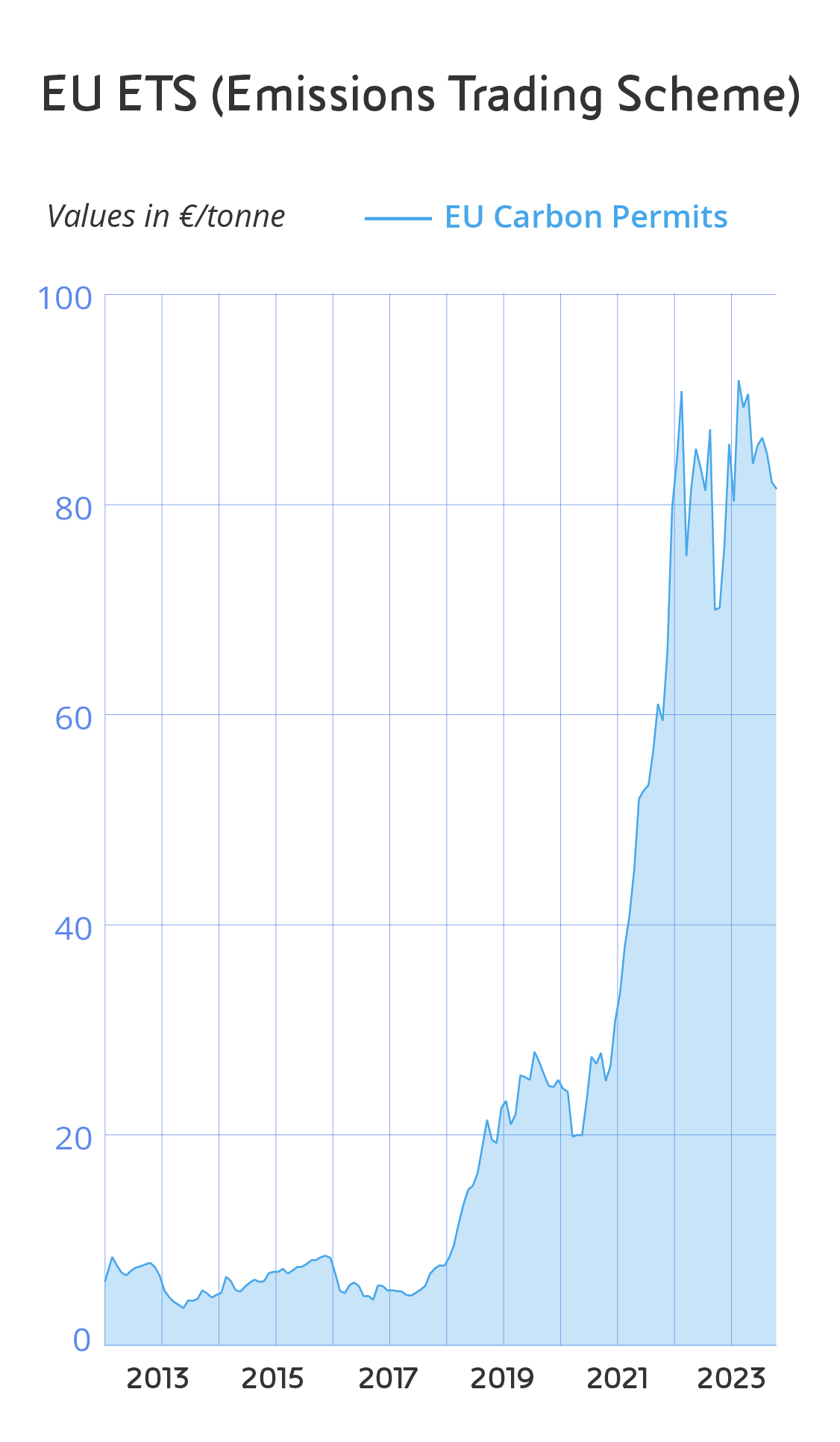

In an effort to encourage the reduction of climate-changing emissions, the European Union approved the European Union Emissions Trading Scheme (EU ETS) in 2009, a tax directly linked to the amount of greenhouse gases emitted by companies. Europe's approach is arguably the most sophisticated, but there are similar schemes either in operation or under consideration around the world. The common goal of such mechanisms is to motivate companies to invest in more sustainable processes or technologies to reduce emissions. However, the vast majority of countries around the world have yet to implement any form of emissions taxation. In terms of the ETS framework, the cost of carbon dioxide emissions has risen from €20 per tonne in 2020 to more than €80 per tonne in 2023. Over the coming decades, this rise will gain momentum as Europe intends to use the ETS system in its commitment to achieve carbon neutrality by 2050.

Our Channels

enioilproducts

Your business, our energy

Produtcs and solutions for business and customers Italy and abroad