Page 30 - EniFor2016_Report_eng

P. 30

28 Eni for 2016 | Operating model

Upstream

model

The upstream model is based on exploration, which is the driver of:

Dual exploration

Organic Competitive Flexibility model for early

growth cost structure monetization of

discoveries

The exploration strategy is guided flows and dilute long-term risks. of the quality of the discoveries and

by the objectives of shortening Furthermore, Eni has a high the model’s flexibility, was 193%,

time-to-market and cost percentage of operatorship, which Eni’s best ever result. It has been

optimization when converting will reach 90% in start-ups over achieved completely organically

discoveries into productions. the next 4 years. This will ensure by generating value from the

Eni has adopted a development there is firm control of costs, discoveries made. The heart of this

in stages approach in order to timings and risks. In 2016 the rate strategy and these results lies in the

speed up start-ups and cash of reserve replacement, indicator enhancement of people.

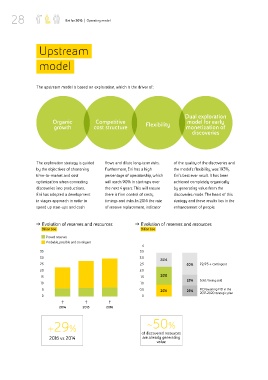

˛ Evolution of reserves and resources ˛ Evolution of reserves and resources

Billion boe Billion boe

Proved reserves

Probable, possible and contingent

4

35 3.5

30 3.0

2016

25 2.5 50% P2/P3 + contingent

20 2.0

15 1.5 2015

25% Sold / being sold

10 1.0

5 0.5 2014 25% FID/awaiting FID in the

2017-2020 strategic plan

0 0

2014 2015 2016

+29% ≈50%

of discovered resources

2016 vs 2014 are already generating

value